The bull put spread is a powerful options strategy for generating income, but moving from textbook theory to real-world application can be intimidating. We’ve all been there—staring at a definition, understanding the mechanics, but feeling a gap between that knowledge and the confidence to place a real trade. Simply knowing what a credit spread is isn’t enough; successful trading requires seeing how the strategy performs under different market conditions, on various assets, and in response to specific events. This article is designed to bridge that gap by providing a deep dive into practical, detailed bull put spread examples.

Instead of offering generic overviews, we will dissect six distinct trading scenarios. You will see the exact options chosen, the premiums collected, and the specific risk-reward calculations for each trade. We will analyze why certain strike prices were selected, how implied volatility influenced the position, and what the potential outcomes were based on the stock’s price action.

This isn’t about finding a magic formula for guaranteed profits — that doesn’t exist in trading. It’s about building the strategic thinking and disciplined analysis necessary for long-term consistency. From a tech giant like Apple to a broad market ETF like SPY, each example is designed to equip you with replicable tactics and actionable insights. Our goal is to move you beyond the basics and help you master the art and science of the bull put spread.

1. Tech Stock Bull Put Spread on Apple (AAPL)

A classic application of the bull put spread strategy involves large, liquid tech stocks like Apple (AAPL). This strategy is ideal for traders who are moderately bullish or neutral on a stock’s short-term direction. By selling a higher-strike put option and simultaneously buying a lower-strike put with the same expiration, you collect a net credit. The goal is for the stock price to stay above the higher strike price (the short put) through expiration, allowing you to keep the entire premium.

This setup offers a defined-risk approach to generating income. We all worry about runaway losses, and unlike selling an uncovered put where potential losses can be substantial, the long put acts as a protective “floor,” capping your maximum potential loss to the difference between the strikes minus the credit received. This makes it one of the more popular bull put spread examples for traders seeking consistent returns with controlled risk.

Trade Breakdown: The September 2023 Example

Let’s analyze a specific scenario to see how this plays out. In September 2023, with AAPL trading around $185 per share, a trader could implement the following spread:

- Sell to Open: 1 AAPL $180 Put for a $3.50 premium ($350 credit)

- Buy to Open: 1 AAPL $175 Put for a $1.50 premium ($150 debit)

This transaction results in a net credit of $2.00 per share, or $200 for one contract. The maximum profit is capped at this $200 credit, realized if AAPL closes at or above $180 on expiration. The maximum risk is $300, calculated as the spread width ($5) minus the credit ($2), multiplied by 100.

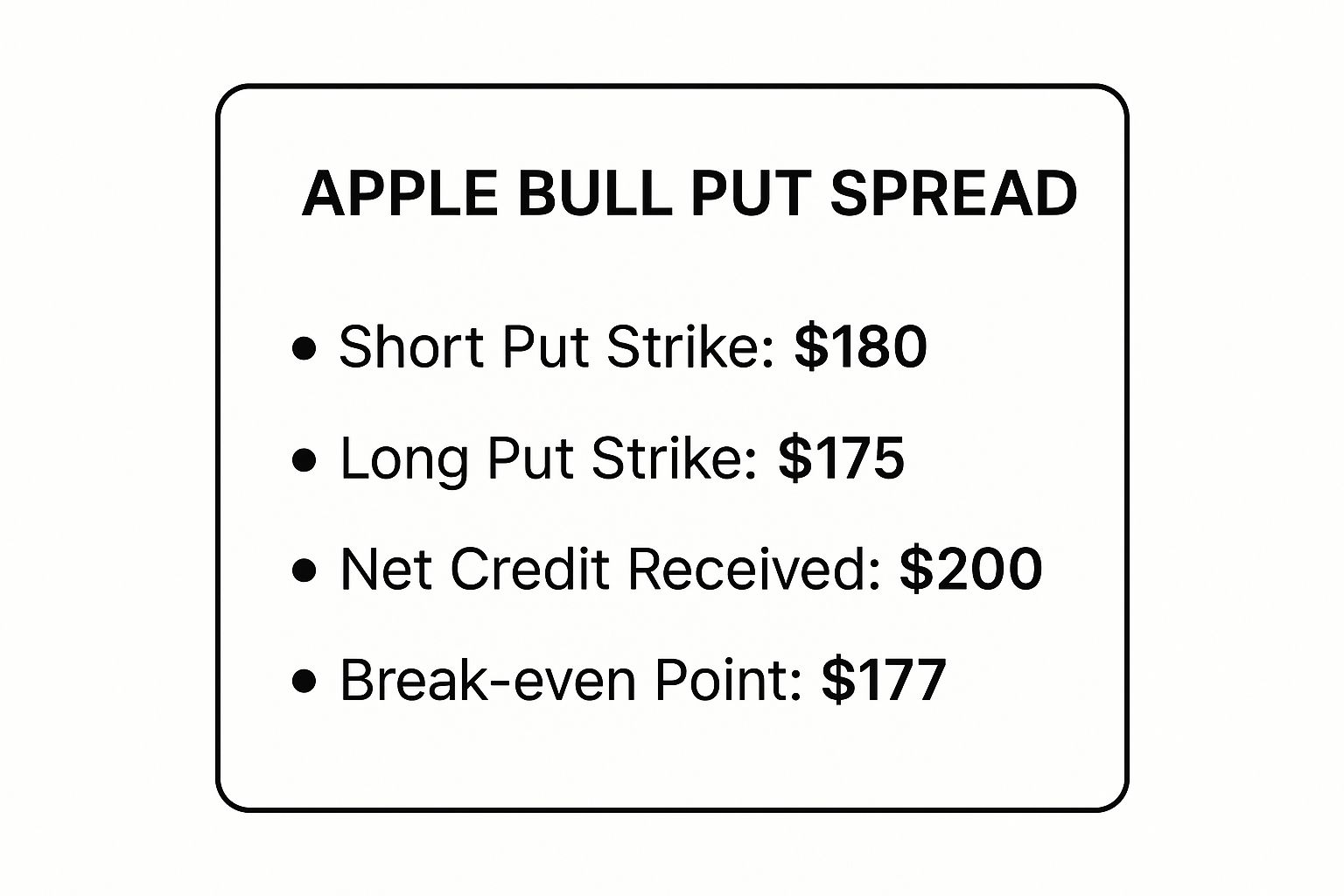

The infographic below summarizes the core components of this trade.

This visualization highlights the break-even point at $178.00, which is the short strike price ($180) minus the net credit received ($2.00). As long as AAPL stays above this price, the trade is profitable.

Strategic Tips for AAPL Spreads

When executing bull put spreads on a stock like Apple, discipline and a long-term mindset are paramount. Anyone promising “guaranteed profits” is selling a fantasy; instead, focus on managing probabilities and risk.

Key Insight: The primary objective of a high-probability bull put spread is not to predict a massive rally, but to correctly predict a price level the stock will not fall below. This is a subtle but crucial shift in thinking.

Here are actionable takeaways for implementation:

- Target the Right Delta: Delta is a Greek that estimates the probability of an option expiring in-the-money. Aim for a short put delta between .16 and .20. This range often provides a healthy balance between premium received and the probability of the option expiring worthless.

- Profit Taking Discipline: Don’t get greedy and wait for every last penny. A prudent rule is to close the position when you have captured 25-50% of the maximum potential profit. This reduces your exposure to sudden market reversals and the risks associated with options assignment.

- Manage Volatility: Enter bull put spreads when implied volatility (IV) — the market’s forecast of a likely movement in a security’s price — is elevated. Higher IV means richer option premiums, increasing your credit and widening your break-even point. Avoid setting up new spreads just before major earnings announcements unless your strategy is specifically designed to profit from the post-announcement volatility crush.

2. Index ETF Bull Put Spread on SPY

Applying the bull put spread to a highly liquid, diversified index ETF like the SPDR S&P 500 ETF (SPY) is a cornerstone strategy for many options traders. Instead of betting on a single company, you are taking a position on the broad U.S. market. This approach is ideal for traders who are moderately bullish on the market’s overall direction or simply believe it will not experience a significant short-term decline.

This strategy involves collecting a net credit by selling a higher-strike put and buying a lower-strike put, aiming for SPY to remain above the short strike at expiration. The inherent diversification of an index ETF often results in smoother price action compared to individual stocks, reducing the risk of sharp, company-specific downturns. This makes SPY one of the most reliable bull put spread examples for generating consistent income with defined risk. The immense liquidity also ensures tight bid-ask spreads, making entries and exits more efficient.

Trade Breakdown: The October 2023 Example

Let’s examine a real-world scenario during a period of market uncertainty. In early October 2023, with SPY trading around $445, a trader anticipating support could have initiated the following spread:

- Sell to Open: 1 SPY $440 Put for a $3.00 premium ($300 credit)

- Buy to Open: 1 SPY $435 Put for a $1.75 premium ($175 debit)

This trade generates a net credit of $1.25 per share, or $125 for one contract. The maximum profit is this $125 credit, which is realized if SPY closes at or above $440 upon expiration. The maximum risk is capped at $375, calculated as the spread width ($5) minus the net credit ($1.25), multiplied by 100. The break-even point for this trade is $438.75 (the short strike of $440 minus the $1.25 credit).

Strategic Tips for SPY Spreads

Trading SPY spreads requires a macro view and disciplined execution. It’s not about catching a massive market rally but about correctly identifying a price level that the broad market is likely to hold. It’s a game of patience and probability.

Key Insight: The primary advantage of using an index ETF like SPY is its diversification, which insulates your position from the specific risk of a single stock’s bad earnings report or negative news event.

Here are actionable takeaways for implementation:

- Mind the VIX: A powerful tactic is to enter new spreads when the CBOE Volatility Index (VIX), often called the “fear index,” is elevated, ideally above 20. Higher implied volatility leads to richer option premiums, increasing your potential credit and improving your risk-reward ratio.

- Utilize Weekly Options: SPY offers highly liquid options with multiple expirations per week. Using weekly options allows for more frequent income generation and the ability to precisely time your trade around specific economic events like FOMC meetings.

- Target a Return on Risk: Instead of chasing the highest premium, aim for a consistent return on your capital at risk. A common target among experienced traders is a 15-20% return on risk for each trade, providing a disciplined framework for position selection.

3. Earnings Play Bull Put Spread Strategy

A more advanced application of this strategy is the earnings play, designed to capitalize on the unique market dynamics surrounding a company’s quarterly report. This approach is for traders who believe a stock will react neutrally or favorably to its earnings announcement. By opening a bull put spread just before the report, you aim to profit from both a positive price reaction and the predictable collapse in implied volatility (IV), known as “IV crush,” that occurs after the news is public.

This setup offers a defined-risk way to play a high-volatility event. Many traders get burned buying calls or puts before earnings, only to see them lose value from IV crush even if the direction is right. The bull put spread, however, benefits from it. The premium collected is inflated due to pre-earnings uncertainty, and this premium rapidly decays once the uncertainty is resolved, making it one of the more tactical bull put spread examples for event-driven traders.

Trade Breakdown: The Netflix Q3 2023 Example

Let’s examine how this strategy could have been applied to Netflix (NFLX) ahead of its Q3 2023 earnings report. With NFLX trading around $435 per share and high anticipation for subscriber numbers, a trader could implement the following spread:

- Sell to Open: 1 NFLX $420 Put for a $12.50 premium ($1,250 credit)

- Buy to Open: 1 NFLX $415 Put for a $10.50 premium ($1,050 debit)

This trade generates a net credit of $2.00 per share, or $200 for one contract. The maximum profit is this $200 credit, which would be realized if NFLX closed above $420 at expiration. The maximum risk is calculated as the spread width ($5) minus the credit ($2), multiplied by 100, which equals $300. The stock subsequently gapped up on a strong subscriber beat, causing the spread to expire worthless and securing the full profit.

Strategic Tips for Earnings Spreads

Executing bull put spreads around earnings is a high-stakes game that demands precision and a clear understanding of risk. Overconfidence can lead to significant losses if the stock moves sharply against your position — a painful lesson many of us have learned.

Key Insight: The earnings bull put is a bet on two factors: the stock not collapsing and implied volatility decreasing. Your profit comes from the rapid decay of the inflated premium you collected.

Here are actionable takeaways for implementation:

- Use the Expected Move: Most trading platforms provide the market’s “expected move,” which is the one-standard-deviation price range anticipated after earnings. Selling your put spread outside of this range increases your probability of success by aligning your trade with market expectations.

- Close the Position Quickly: The goal is to capture the profit from the post-earnings price reaction and IV crush, not to hold on for weeks. A good practice is to close the trade on the morning after the announcement if it’s profitable, thus avoiding exposure to any subsequent market noise. This is a crucial element of many successful options trading strategies.

- Analyze Historical Reactions: Research how the stock has historically reacted to earnings. Does it tend to beat expectations? Is the post-earnings drift usually positive? Companies with a history of positive responses or muted drops are often better candidates for this strategy.

4. High Dividend Stock Bull Put Spread on Verizon (VZ)

Applying a bull put spread to high-dividend stocks like Verizon (VZ) introduces a unique strategic layer. This approach is well-suited for income-focused traders who are moderately bullish or neutral on stable, dividend-paying companies. The core idea is that the stock’s attractive dividend yield can create a natural “floor” of buying support from income investors, making it less likely to experience sharp, sustained downturns.

This setup allows you to generate options premium while benefiting from the defensive characteristics of established dividend payers. By selling a higher-strike put and buying a lower-strike one, you collect a credit, and your goal is for the stock to remain above your short strike. The inherent stability of these stocks, combined with the downside protection of a defined-risk spread, makes this one of the more conservative bull put spread examples for portfolio income.

Trade Breakdown: The Dividend Season Example

Let’s examine a scenario involving Verizon (VZ) during a period where its high yield is particularly attractive to investors. With VZ trading around $40 per share and sporting a high dividend yield, a trader could implement the following spread:

- Sell to Open: 1 VZ $38 Put for a $0.95 premium ($95 credit)

- Buy to Open: 1 VZ $36 Put for a $0.45 premium ($45 debit)

This transaction generates a net credit of $0.50 per share, or $50 for one contract. The maximum profit is this $50 credit, which is realized if VZ closes at or above $38 at expiration. The maximum potential loss is capped at $150, calculated as the spread width ($2) minus the credit ($0.50), multiplied by 100. The break-even point for this trade would be $37.50 (the short strike of $38 minus the $0.50 credit).

Strategic Tips for Dividend Stock Spreads

Executing bull put spreads on high-yield stocks requires an understanding of how dividends and interest rates affect their price behavior. Success depends on more than just collecting a premium; it involves aligning your trade with the stock’s fundamental characteristics.

Key Insight: The dividend yield on a stock acts as a form of “gravity” that can attract buyers when the price drops, providing a psychological support level that can work in favor of your short put strike.

Here are actionable takeaways for this strategy:

- Focus on Dividend Aristocrats: Prioritize stocks with a long history of consecutive dividend increases. These companies, often called Dividend Aristocrats, typically have more stable business models and are less prone to extreme volatility.

- Time Entries Carefully: Consider entering trades after the ex-dividend date. Stocks often experience a slight, predictable price drop on this date equal to the dividend amount. Waiting until after this event can prevent an immediate, temporary move against your position.

- Use Wider Time Frames: Slower-moving dividend stocks often require more time for your thesis to play out. Using expirations of 60-90 days to expiration (DTE) can provide a better balance of premium decay and room for the stock to stay above your strikes. This approach to timing is a core component of effective risk management techniques for options trading.

- Monitor Interest Rates: High-dividend stocks can be sensitive to changes in interest rates. When rates rise, the appeal of dividend yields can diminish, potentially putting downward pressure on these stocks. Be aware of the broader macroeconomic environment.

5. Volatility Crush Bull Put Spread

A more advanced application of this strategy focuses on profiting from a contraction in implied volatility (IV), often called a “volatility crush.” This approach is ideal for traders who anticipate a stock will remain stable or rise slightly after a major, scheduled event like an earnings report, a product launch, or an FDA announcement. By selling an options spread when IV is high just before the event, you collect an inflated premium. The goal is for the event to pass, volatility to revert to its mean, and the option prices to deflate rapidly, allowing you to close the trade for a quick profit.

This setup leverages the market’s pre-event uncertainty, which drives up option prices. Unlike a standard directional trade, the primary profit driver here is the decrease in IV, not necessarily a large move in the stock price. The long put still provides a defined-risk structure, capping potential losses if the event’s outcome is unexpectedly negative and causes a sharp price drop. This makes it a strategic choice among bull put spread examples for event-driven traders.

Trade Breakdown: The Biotech Event Example

Let’s analyze a scenario with a biotech company, XBI Corp, awaiting FDA approval results. With XBI trading at $50 and IV Rank at 90% (historically very high), a trader expecting a favorable outcome or a non-event could implement the following spread:

- Sell to Open: 1 XBI $47.50 Put for a $1.80 premium ($180 credit)

- Buy to Open: 1 XBI $45.00 Put for a $0.80 premium ($80 debit)

This transaction establishes a net credit of $1.00 per share, or $100 for one contract. The maximum profit is this $100 credit. The maximum risk is the spread width ($2.50) minus the credit ($1.00), multiplied by 100, which equals $150. Post-announcement, even if XBI’s stock price doesn’t move, a drop in IV from 90% to 40% could significantly reduce the spread’s value, allowing the trader to buy it back for a fraction of the credit received.

Strategic Tips for Volatility Spreads

Executing volatility-crush spreads requires a deep understanding of market dynamics around specific events. Success is not about a “get rich quick” scheme but about systematically harvesting inflated premiums while strictly managing risk.

Key Insight: The goal is not just to be right about the stock’s direction, but to correctly identify situations where option premiums are excessively high due to market uncertainty and are likely to fall after that uncertainty is resolved.

Here are actionable takeaways for implementation:

- Use IV Tools: Screen for opportunities using Implied Volatility (IV) Rank or IV Percentile. These tools tell you if the current IV is high or low compared to its own history. Only enter these trades when IV Rank is above 50, indicating that current volatility is high compared to its past 12 months.

- Study Historical Patterns: Analyze how a specific stock has reacted to past earnings calls or similar events. Does IV consistently crush? Does the stock tend to drift up or down? This historical context provides a statistical edge.

- Aggressive Profit Taking: This is not a “set it and forget it” strategy. Aim to close the position for a 25-40% profit shortly after the event, often within the same or next trading day. Holding on for the full premium exposes you to unnecessary post-event market risk.

- Binary Events are Risky: Be extremely cautious with binary events like clinical trial results where the stock could gap down 50% or more. Ensure your position size is small, as the defined-risk nature of the spread is your only protection against a catastrophic move.

6. Support Level Bull Put Spread

A powerful way to enhance the probability of a bull put spread is to combine it with technical analysis. This strategy involves placing the short strike of your spread at or just below a well-established technical support level. By identifying where a stock has historically found buying pressure, you align your trade with the market’s structure, increasing the odds that the price will remain above your strike.

This approach leverages chart patterns, moving averages, and historical price action to pinpoint optimal entry points. Instead of relying solely on probabilities (like delta), you’re making an informed decision based on visible market behavior. This method of finding bull put spread examples is popular among traders who are adept at chart reading and want to add a layer of confirmation to their income strategies. For those looking to sharpen these skills, understanding how to read stock charts is a critical first step.

Trade Breakdown: The Tesla (TSLA) Example

Let’s examine a scenario where Tesla (TSLA) is trading around $215 and showing signs of consolidating near a key support level at $200. This level is significant because it aligns with a prior price floor and the 50-day moving average, creating a confluence of technical strength. A trader could structure a bull put spread to capitalize on this support.

- Sell to Open: 1 TSLA $195 Put for a $4.10 premium ($410 credit)

- Buy to Open: 1 TSLA $190 Put for a $2.60 premium ($260 debit)

This trade generates a net credit of $1.50 per share, or $150 for one contract. The maximum profit is this $150 credit, which is realized if TSLA closes above $195 at expiration. The maximum risk is calculated as the width of the spread ($5) minus the credit ($1.50), resulting in a potential loss of $3.50 per share, or $350.

The image below illustrates how support levels act as a potential floor for a stock’s price, making them ideal locations for placing short put strikes.

This visual shows that the breakeven point for this trade is $193.50 (the short strike of $195 minus the $1.50 credit). As long as TSLA respects the technical support at $200 and stays above $193.50, the trade will be profitable.

Strategic Tips for Support-Based Spreads

Using technical analysis requires patience and confirmation; it’s not about predicting the exact bottom but identifying an area where selling pressure is likely to subside. Discipline is crucial to avoid emotional decisions if a support level is tested.

Key Insight: The goal isn’t to catch a falling knife. It’s to wait for the stock to prove its stability at a support level before entering a spread below it.

Here are actionable takeaways for implementation:

- Wait for Confirmation: Don’t place a spread just as a stock is falling toward support. Look for signs of a bounce or consolidation, such as a bullish candlestick pattern or slowing momentum, before entering the trade.

- Use Multiple Timeframes: A support level is much stronger if it’s visible on daily, weekly, and monthly charts. This confluence across different timeframes increases the reliability of the level holding.

- Set Clear Invalidation Points: If the stock breaks decisively below your chosen support level, it’s a sign that your thesis is wrong. Have a plan to close the trade for a small loss rather than hoping for a recovery.

- Combine with Oscillators: Use indicators like the Relative Strength Index (RSI) to confirm oversold conditions. Entering a bull put spread when a stock is testing support and the RSI is below 30 can further improve your probability of success.

Bull Put Spread Strategy Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Tech Stock Bull Put Spread on Apple (AAPL) | Moderate – requires margin account and strike selection | Moderate capital and margin required | Limited profit (credit received) with capped max loss | Neutral to bullish markets with elevated IV | Immediate income, limited loss, high profit probability |

| Index ETF Bull Put Spread on SPY | Low to Moderate – broad market ETF, liquid options | Lower margin compared to stocks, highly liquid | Moderate premium, consistent income generation | Broad market exposure, times of market stability | High liquidity, diversified risk, flexible expirations |

| Earnings Play Bull Put Spread | High – needs earnings analysis, timing precision | Intensive research and timing before earnings | High premium from IV expansion, quick profits | Earnings season, companies with history of beats | Enhanced premium, profits from IV crush and stock move |

| High Dividend Stock Bull Put Spread | Moderate – requires dividend and sector knowledge | Moderate capital, focus on defensive stocks | Lower premiums, steady income with dividend support | Defensive sectors, dividend capture strategies | Dividend support, lower volatility, suitable for conservative investors |

| Volatility Crush Bull Put Spread | High – advanced volatility knowledge, timing critical | Sophisticated tools for volatility ranking | Profits from IV contraction, less directional risk | Before volatility events (earnings, FDA, announcements) | High premium collection, profits even with modest adverse moves |

| Support Level Bull Put Spread | High – requires technical analysis skills | Moderate capital, technical tools needed | Higher probability trades based on technical confluence | Technical traders targeting key support levels | Defined risk levels, systematic application, combines charts with options |

Turning Examples into Your Edge: The Power of Systematic Review

We’ve journeyed through a diverse set of bull put spread examples, moving from a straightforward trade on a tech giant like Apple to more nuanced strategies involving earnings events and key technical support levels. Each scenario was designed not just to show you what a bull put spread is, but how it functions in the real world, with all its variables and potential outcomes. The goal was to move beyond theory and into practical, tactical application.

By analyzing these varied examples, from the broad market exposure of an SPY spread to a targeted dividend stock play, a clear pattern emerges. Success isn’t about finding one “perfect” setup; it’s about building a flexible, disciplined framework for identifying and managing high-probability trades. The true value of these examples lies in the strategic thinking behind each one.

From Passive Observation to Active Strategy

The difference between a novice and a seasoned options trader is the ability to internalize these lessons. It’s about recognizing the conditions that favored the volatility crush play or understanding the risk management required for an earnings spread. The examples in this article serve as a blueprint, but your unique trading edge will come from adapting these blueprints to your own style, risk tolerance, and market outlook.

Here are the core principles to carry forward:

- Context is King: A bull put spread is never executed in a vacuum. Your success depends on the underlying reason for your bullish bias, whether it’s a strong technical support level, an anticipated earnings beat, or a broad market uptrend.

- Risk Defines Reward: Every example highlighted the trade-off between the premium collected and the maximum potential loss. Your primary job is to be a risk manager first and a profit-seeker second. Always know your max loss and be comfortable with it before entering any trade.

- Strike Selection is an Art: Choosing your short and long put strikes is the most critical decision you’ll make. It directly impacts your probability of profit, your potential return on risk, and your margin for error if the underlying stock moves against you.

Your Path to Consistent Application

Mastering the bull put spread, or any options strategy, is a marathon, not a sprint. The path forward involves deliberate practice and meticulous review. Don’t just place trades; study them. Ask yourself why a trade worked or why it failed. Was your initial analysis correct? Did you manage the position according to your plan? This process of systematic review is what turns isolated trades into a robust, long-term strategy. The detailed bull put spread examples we’ve covered provide the foundation, but your personal trade journal is where true mastery is forged.

Ultimately, these strategies are tools. Like any tool, their effectiveness depends entirely on the skill of the person using them. By committing to a process of continuous learning and disciplined review, you can transform these examples from passive reading material into an active, profitable part of your trading arsenal.

Ready to stop guessing and start analyzing? The examples we covered show the power of breaking down trades. TradeReview is a dedicated journaling platform designed to help you systematically track, review, and optimize every bull put spread you place, turning your trading history into your greatest strategic asset. Start your free trial at TradeReview and build your edge.