When you pull up a chart, the sheer amount of data can feel like staring into a blizzard of candlesticks and numbers. We’ve all felt that initial overwhelm. Moving averages are your first line of defense against this chaos. They act as a filter, smoothing out the day-to-day price swings to give you a clear, single line that shows the underlying trend.

Think of it as cutting through the noise. Instead of getting bogged down by every little price tick, you get a clean, flowing line that tells a much bigger story about market sentiment. This tool isn’t about promising guaranteed profits; it’s about giving you a disciplined framework for making sense of the market.

Reading the Lines on Your Trading Chart

This single line is surprisingly powerful. It can instantly tell you whether buyers or sellers are in control, all without cluttering your screen with a dozen different indicators. Your first job is simply to learn how to interpret what this line is telling you.

What Is a Moving Average?

At its heart, a moving average (MA) is just the average price of an asset over a specific number of periods. For instance, a 20-day moving average is the average closing price of the last 20 trading days. By plotting this average as a continuous line, you get a smoothed-out view of the price action.

This isn’t some new-fangled concept; it’s been a cornerstone of technical analysis for over a century. A Simple Moving Average (SMA), for example, might track the average price over 50 or 200 days. If a stock consistently holds above its 200-day SMA, that’s a classic sign of long-term investor confidence — a strong, healthy uptrend.

Identifying the Market Trend

The number one job of a moving average is to answer a simple but critical question: Which way is the market headed? The relationship between the current price and the moving average line gives you an immediate visual clue.

- Uptrend: When the price is consistently trading above the moving average, and the line itself is pointing up, you’re looking at a bullish trend. Buyers are in control.

- Downtrend: If the price is stubbornly staying below a downward-sloping moving average, that signals a bearish trend. Sellers have the upper hand.

- Sideways Market: Is the price just chopping back and forth across a relatively flat moving average? That’s a classic sign of a consolidating market with no clear direction.

We’ve all been there — getting caught on the wrong side of a big move. A moving average gives you a simple, objective rule to follow: trade with the trend, not against it. This discipline alone can save you from a world of emotional trading mistakes. It encourages long-term thinking by helping you stay in a strong trend instead of panicking on every small dip.

Mastering this basic relationship is your first step. Before you can even think about strategy, you need to confidently read what the chart is telling you. For a deeper dive into chart analysis, check out our guide on how to read stock charts. Building this foundation is key to making more informed trading decisions.

Choosing the Right Tool for Your Strategy

Not all moving averages are created equal. Think of it like a mechanic picking the right wrench for a specific job — you need the right tool for the task at hand. The two most common types you’ll run into are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Getting a handle on their core differences is the first step to aligning your charts with your trading style.

An SMA is the calm, steady hand. It gives equal weight to all prices in its calculation period, which smoothes out the data and gives you a clean, big-picture view of the market’s direction. It’s fantastic at filtering out the day-to-day “noise.”

On the flip side, an EMA puts more weight on the most recent prices. This makes it far more responsive and quicker to react to sudden market shifts. It’s the more agile of the two, built to catch changes in momentum as they happen.

SMA vs EMA: Which Moving Average Should You Use?

So, which one belongs on your charts? There’s no single “best” option — only the best one for what you’re trying to accomplish. Your trading style will be the ultimate guide.

The table below breaks down the key distinctions to help you decide.

| Characteristic | Simple Moving Average (SMA) | Exponential Moving Average (EMA) |

|---|---|---|

| Calculation | Averages all prices equally over the period. | Gives more weight to recent prices. |

| Responsiveness | Slower to react to price changes. | Faster to react to price changes. |

| Best For | Identifying long-term, stable trends. | Catching short-term momentum shifts. |

| Signal Lag | More lag, which can lead to later signals. | Less lag, providing earlier signals. |

| “Noise” Level | Smoother line, less susceptible to short-term spikes. | More “whipsaws” due to its sensitivity. |

| Common Use | Long-term investors, position traders. | Day traders, swing traders. |

Ultimately, SMAs are great for confirming major, established trends, while EMAs excel at getting you into moves a bit earlier, though sometimes at the cost of more false signals.

Practical Applications: When to Use Each

Let’s get practical. Here’s how different traders typically use them:

- For Long-Term Trend Following: The SMA is the go-to. Its slower, smoother nature helps you ride a major trend without getting shaken out by minor corrections. Investors famously watch the 50-day and 200-day SMAs to gauge the overall health of an asset. For example, a long-term investor might decide to only hold positions in stocks that are trading above their 200-day SMA.

- For Short-Term Trading: Day traders and swing traders often lean on the EMA. Because it reacts faster, it can flag earlier entry and exit signals in volatile markets. Popular settings for this style include the 10-period and 20-period EMAs. A swing trader might use the 20-period EMA on a daily chart, looking to buy when the price pulls back and bounces off it in a clear uptrend.

It’s easy to get lost searching for the “perfect” setting. We understand the temptation. The truth? Consistency matters more. Pick a type and period that fits your strategy and stick with it. Constantly switching indicators is a classic trap that just leads to confusion and missed trades.

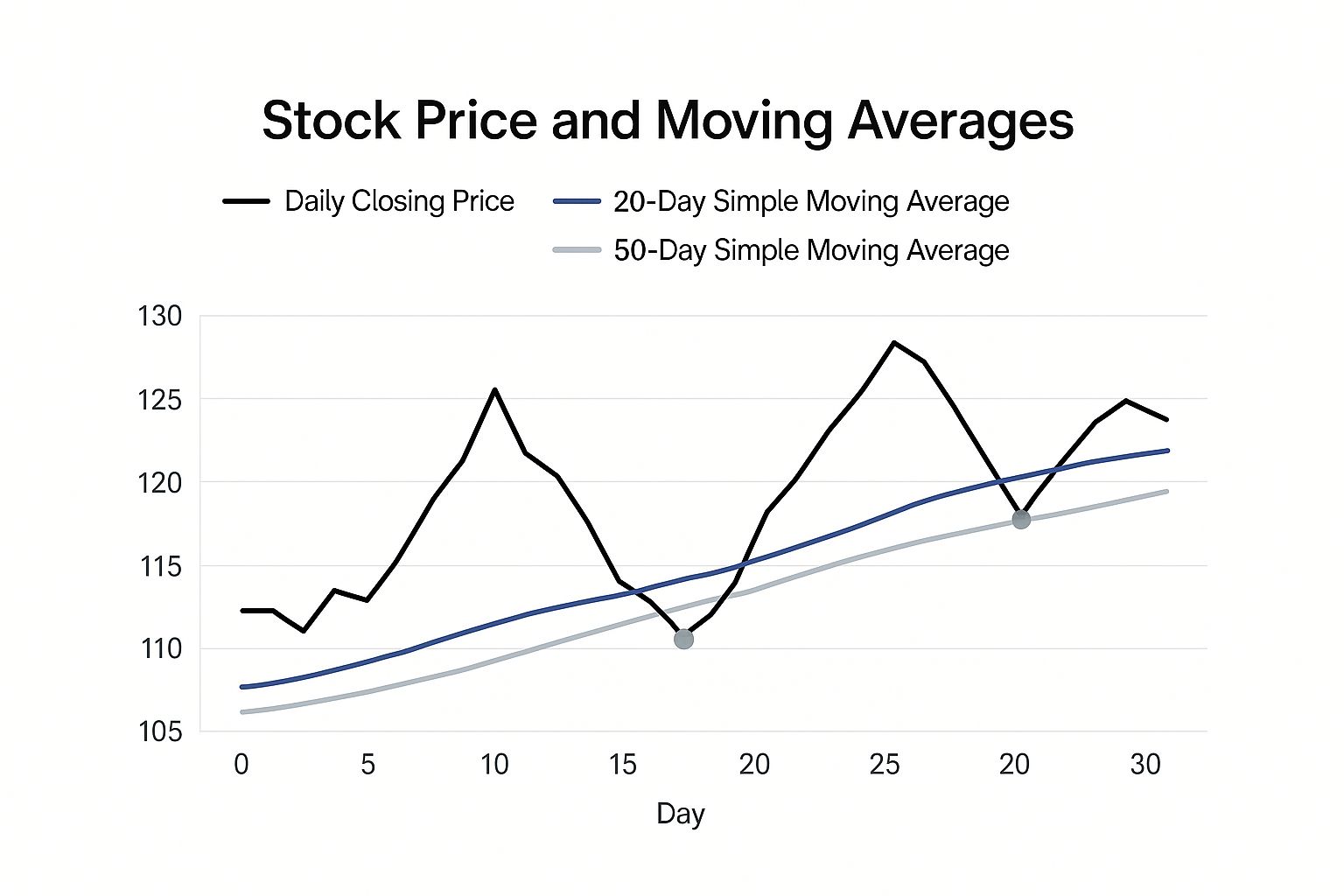

The image below gives you a great visual of how a 20-day and 50-day SMA interact with daily prices, smoothing out the volatility and making the underlying trend clearer.

Look closely at how the price bounces off or crosses these averages. Those interaction points, especially the crossovers, can often signal a shift in market sentiment.

Tailoring Periods to Your Timeline

The “period” or “length” you choose is just as important as the type of moving average. A shorter period makes the line hug the price closely, making it very sensitive. A longer period creates a smoother, slower-moving line.

Here’s a simple guide to matching periods with your trading horizon:

- Day Trading: Think short and fast. Periods like the 9, 12, or 21 EMA are popular for spotting intraday momentum and quick reversals.

- Swing Trading: You’re looking at moves over several days or weeks. The 20 and 50 SMA/EMA are classics for capturing these medium-term trends.

- Position Trading: This is about the big picture. The 100 and 200 SMA are standard for defining the long-term, overarching trend of the market.

Trying to use a 200-day average for scalping is a recipe for frustration, just like a 9-period EMA is way too noisy for long-term investing. The goal is always to match the tool’s sensitivity to your holding period.

This is a very different approach from set-it-and-forget-it investment strategies. For instance, if you want to learn how to invest fixed amounts over time regardless of indicators, you can read our guide that explains what dollar-cost averaging is and how that works. But for active trading, your success hinges on using the right moving averages for your specific goals.

Putting Moving Averages into Practice

Alright, you’ve picked your tools. Now it’s time to get them on your charts and see how they work in the real world. This is where theory meets reality.

We’re going to walk through three core strategies that traders lean on every single day. We’ll start with simple trend confirmation and build up to more nuanced signals. Just remember, these are frameworks for analysis — not crystal balls promising guaranteed returns.

The whole point is to build a systematic approach you can rely on. So many traders get into trouble because they bounce from one shiny new signal to another without a consistent plan. By really getting a handle on a few proven methods, you’ll build the discipline needed to navigate the markets with more confidence.

Dynamic Support and Resistance

Instead of seeing moving averages as rigid lines, think of them as flowing, dynamic zones of potential support or resistance.

In a healthy uptrend, it’s common to see the price pull back to a moving average, find a pocket of buyers, and then bounce higher. The opposite is true in a downtrend. The average can act like a ceiling, putting a lid on any rallies before the price heads back down.

Practical Example: A swing trader notices a stock is in a strong uptrend above its 50-day SMA. They decide to wait for a pullback. The price drops for three days and touches the 50-day SMA, where it forms a bullish candlestick. This becomes their entry signal, placing a stop-loss just below the moving average. This isn’t about chasing the price; it’s about patiently waiting for it to come back to a logical area of value.

A common rookie mistake is treating the moving average as an exact price. It’s much better to see it as a ‘zone of interest.’ Price might dip a little below it or stop just shy. The real clue is watching how the price reacts around the average, not just if it tags it perfectly. Patience and discipline are key here.

The Famous Moving Average Crossover

This is one of the most classic signals in all of technical analysis. A moving average crossover happens when a shorter-term MA crosses above or below a longer-term MA. It’s a simple, visual cue that suggests a potential shift in momentum is underway.

The crossover is a foundational technique used in markets all over the world, mainly because it’s so clear at identifying trends. The two most famous patterns are the “Golden Cross” and the “Death Cross,” which almost always involve the 50-day and 200-day SMAs.

- Golden Cross (Bullish): This is when a shorter-term MA (like the 50-day) crosses above a longer-term MA (like the 200-day). It suggests that recent momentum is getting stronger than the long-term trend, signaling a potential new uptrend.

- Death Cross (Bearish): This is the opposite. The shorter-term MA crosses below the longer-term one, suggesting short-term weakness is taking over and a downtrend might be starting.

These signals are watched like a hawk on major indices like the S&P 500 because they can reflect huge shifts in market sentiment. While they are great in trending markets, be warned: they can generate a lot of false signals when the market is just chopping sideways. You can find more insights on these trading strategies on IG.com.

Keep in mind that these are lagging indicators. The crossover confirms a trend that has already started, so you’re using it for confirmation, not prediction.

Using a Moving Average Ribbon

If you want a more comprehensive view of trend strength and momentum, some traders use a “ribbon” of multiple moving averages. This just means plotting several MAs of different lengths on the same chart — for example, you might use the 10, 20, 30, 40, 50, and 60-period EMAs all at once.

When the lines are fanned out wide, running parallel, and all pointing in the same direction, it’s a clear sign of a strong, healthy trend. The wider the ribbon, the stronger the momentum.

On the other hand, if you see the ribbon start to squeeze together or the lines begin to tangle and cross over each other, that’s a warning. It signals that the trend is losing steam or consolidating. This can be an early heads-up that a reversal or a period of choppy, messy price action is on the horizon. The ribbon lets you gauge the health of a trend with just a quick glance.

Common Mistakes to Avoid with Moving Averages

Knowing how to plot a moving average is just the first step. The real skill comes from understanding the common pitfalls that trip up so many traders. These simple lines are powerful, but they’re also littered with traps that are incredibly easy to fall into, especially when you’re just getting started.

One of the biggest struggles is treating every signal as a command to act. A crossover happens, you jump in. Price bumps against the 50-day average, and you immediately smash the buy button. This kind of reactive trading completely misses the bigger picture and is a fast track to a string of frustrating losses.

Think of moving average signals as a suggestion to look closer, not a definitive order to trade.

Mismatching Your Tools and Timeframe

A huge amount of frustration comes from a simple, fundamental error: using a long-term indicator for a short-term strategy. It’s like trying to navigate your local neighborhood using a map of the entire country — you have the right tool for the wrong job.

For instance, a day trader or scalper who bases their entries on the 200-day SMA is setting themselves up for failure. That average is built to show the massive, overarching trend. It moves way too slowly to offer any real value for trades that last minutes or hours. It will always be late to the party.

On the flip side, a long-term investor who gets spooked every time the price wiggles across the 9-period EMA is going to get shaken out of perfectly good positions by routine market noise.

Your indicator’s speed needs to match your trading speed. Faster averages for faster trades, slower averages for slower trades. Getting this one alignment right can radically improve your clarity and cut down on so much unnecessary noise.

Ignoring the Market Environment

Here’s the thing about moving averages: they are trend-following indicators. That means they shine when a market has a clear direction. In a strong, steady uptrend or downtrend, they are incredibly effective at highlighting opportunities and keeping you on the right side of the move.

But in a choppy, sideways market? They completely fall apart.

When a stock is just bouncing around in a range, the price will constantly whip back and forth across the moving average, firing off one false signal after another. You’ll get endless crossovers that go nowhere, and lines that looked like support or resistance will suddenly mean nothing. This is where trend traders often give back all their profits. It’s a painful lesson many of us learn the hard way.

- A flat, sideways moving average is a giant warning sign. It’s telling you the market is consolidating and your trend-following strategy is about to get chewed up.

- Always check the environment before you use the tool. In choppy conditions, it’s often smarter to just sit on your hands or switch to a different set of tools designed for range-bound markets.

The Danger of Blindly Following Signals

Finally, a moving average signal should never be the only reason you take a trade. A “Golden Cross” might look great on the chart, but if it happens on weak volume and the price action is uninspired, it’s probably a trap.

A bounce off the 50-day SMA, however, becomes much more powerful when it’s confirmed by a big bullish candlestick and a surge in buying volume.

Real confidence in a trade comes from confluence — that’s when multiple, independent signals all point to the same conclusion. Always ask yourself: What else supports this trade? Is volume confirming the move? Is the price action strong? This multi-layered approach is your best defense against the market’s endless head-fakes.

Combining Indicators for a Clearer Signal

A moving average is a fantastic tool for spotting a trend, but using it all by itself can lead to some painful, costly mistakes. Relying on a single indicator is like trying to find your way with just one landmark; you really need more information to confirm you’re on the right path.

The strongest trading strategies are all built on confluence — that’s when multiple, unrelated signals all point to the same conclusion. This concept is key to developing a robust, long-term approach.

This isn’t about cluttering your chart until you can’t see the price. The real goal is to find one or two other tools that complement your moving average by giving you a different piece of the puzzle. This layered approach helps filter out those tricky false signals and gives you a heck of a lot more confidence when you pull the trigger on a trade.

Adding an Oscillator for Momentum Insight

One of the most effective ways to use moving averages is to pair them with an oscillator, like the Relative Strength Index (RSI). While your moving average confirms the trend’s direction, the RSI measures the speed and strength of price moves. It tells you if a trend is running out of steam.

Practical Example: A stock is in a beautiful uptrend, consistently bouncing off its 50-day EMA. Looks like a textbook buy signal, right? But what if you glance down and see the RSI is at a reading of 75? That’s an overbought condition and a major warning sign.

It tells you that even though the trend is up, the recent buying frenzy might be getting exhausted. A pullback could be just around the corner.

- Moving Average Signal: Price is bouncing off the 50-day EMA. Looks bullish.

- RSI Signal: RSI is at 75, flashing an overbought warning. Time to be cautious.

By combining the two, you can avoid jumping in right at the peak of a short-term rally. Waiting for the RSI to cool off a bit often gives you a much better, less stressful entry point.

So many traders get burned chasing strong trends right before they reverse. An oscillator acts as your discipline partner, telling you when it’s smart to wait for a better pitch, even when the trend itself looks perfect.

Using Indicators Built from Moving Averages

Another powerful method is to use an indicator that’s actually built from moving averages, like the Moving Average Convergence Divergence (MACD). The name sounds technical, but it’s really just a momentum indicator that tracks the relationship between two EMAs.

The MACD is specifically designed to highlight shifts in the strength and direction of a trend. To really dig into this style of trading, check out our guide on what momentum trading is.

Ultimately, the key is to experiment. Open up a demo account and play around with different combinations. See what clicks for you and your style. Discipline and a long-term mindset are your greatest assets here. Build a strategy you can actually stick with, and you’ll already be way ahead of the crowd.

Your Questions on Moving Averages Answered

Jumping into a new trading tool always brings up questions, and moving averages are no different. We’ve all been there — staring at a chart, second-guessing if we’re reading the signals right. Let’s clear up some of the most common questions traders have so you can start using them with confidence.

Can Moving Averages Predict Future Prices?

No, and this is a huge point to understand right away. Moving averages are lagging indicators, which means they’re built using past price data. They don’t have a crystal ball to predict the future; they simply confirm the trend that’s already happening. Anyone promising a tool that guarantees future predictions is not being honest.

Their real power is in smoothing out the noise of day-to-day price swings, giving you a clearer picture of the market’s underlying direction. Think of them as a tool to help you stay on the right side of a trend, not a way to perfectly time tops and bottoms. Believing they can predict prices is a fast track to disappointment.

What Are the Best Moving Average Settings?

This is probably the number one question traders ask, and the honest answer is there are no “best” settings. The right periods depend entirely on your trading style, your timeframe, and what you’re trading.

- A day trader focused on quick scalps might use a 9-period EMA.

- A swing trader holding positions for a few days or weeks will likely lean on the 50-day SMA.

- A long-term investor just wants to see the big picture and will watch the 200-day SMA.

Your job isn’t to hunt for some magical, secret number. It’s to find a setting that fits your trading plan and then use it consistently. Discipline is far more valuable than endlessly tweaking your indicators. This long-term consistency is what builds confidence in your strategy.

Why Did My Moving Average Signal Fail?

Signals fail, and it usually comes down to one of two things. First, you might be using a trend-following tool in a market that isn’t trending. When a stock is just chopping around sideways in a range, moving averages will spit out one false signal after another as the price whipsaws across the line. This is one of the biggest struggles for new traders.

Second, a signal from a single indicator is never a guarantee. A crossover might look perfect on the chart, but without confirmation from something else — like price action or volume — it could easily be a head fake. The best trades have confluence, where multiple signals all point to the same conclusion. At the end of the day, trading is a game of probabilities, not certainties. Learning how to manage the trades that don’t work out is what separates the pros from the amateurs.

Mastering moving averages comes down to practice and review. Tracking your trades — seeing which signals worked and which didn’t under different market conditions — is the only way to truly refine your approach.

TradeReview offers a powerful trading journal designed to help you do just that. By logging your trades and using our detailed analytics, you can turn your past performance into smarter future decisions. Start tracking your progress for free and build the discipline every successful trader needs.